Crowdfunding Websites like Kickstarter & Indiegogo help entrepreneurs & inventors raise funds for individual projects. So, while Kickstarter & Indiegogo focus on funding creative projects & even charity campaigns, there’s now an equity crowdfunding Site that uses the Software as a Service (SaaS) model to help not individual but companies raise money by either offering equity or rewards. Called Fundable, this crowdsourcing platform has its offices in Columbus, Ohio in the USA.

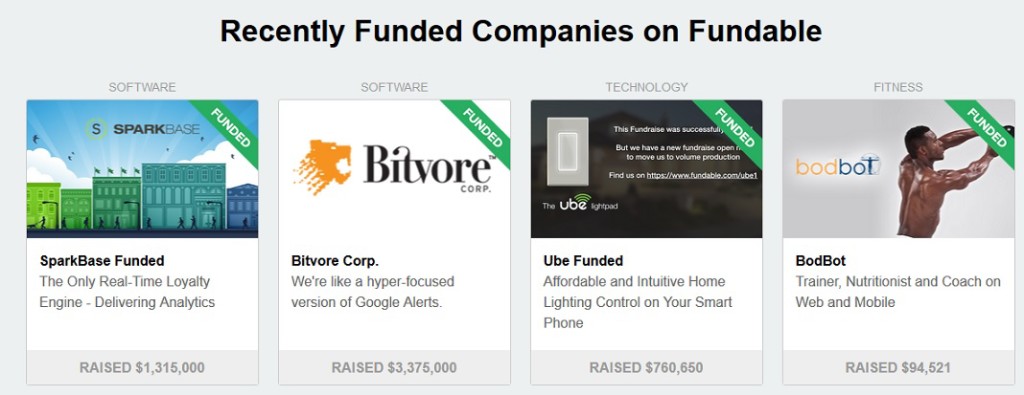

So far, Fundable has helped businesses raise over US $84 million in crowdfunding commitments. The average amount raised on Fundable is $175,000, which, according to one reckoning, is 12 times more than Kickstarter.

Fundable charges a flat fee of $179 per month to create & manage fundraising campaigns. All the proceeds of the campaign go the company, & Fundable does not charge any additional success fee. Many companies including Uncharted Play, Cregle & Ube have come to Fundable for raising additional capital to scale up their business after their funds from the initial campaign on Kickstarter ran out.

Fundable’s goal is to help startups & companies raise capital to develop products & reach their business goals. The company has cultivated relationships with retailers, distribution companies & other entities that need funds for new services & products.

Fundable’s goal is to help startups & companies raise capital to develop products & reach their business goals. The company has cultivated relationships with retailers, distribution companies & other entities that need funds for new services & products.

Fundable was founded with the aim of helping companies raise funds by way of equity. The goal is to broaden the traditional venture capital-funded model of business.

Security is a big problem in the crowdfunding business. Fundable says its community of investors play the role of determining whether products are genuine or not. In how to go about setting fund-raising goals, the Website says under its equity fundraise terms that “equity raises start at a minimum of $10,000 and can go up to $10 million.”

Fundable says it is easy to start a campaign on its Website. Companies merely need a workable idea & product which they should package appropriately to appeal to the audience.

A few days ago, Fundable acquired an Online service named LaunchRock that helps companies build interest in their products before they launch them. Fundable plans to use LaunchRock’s expertise as an additional service for its customers.

Founded in 2012, Fundable has scaled up tremendously in two years & currently features a few hundred projects simultaneously on its Website. Fundable expects the LaunchRock acquisition to increase the number of simultaneous campaigns to the thousands in a short time.

Image credit: fundable.com

Advertising Message